Are you meesho seller? Do you want to generate GST report for tax registration? Follow this article till the last information to get register.

GST registration process is compulsory in meesho even though we don’t have commission and shipping charge. Like wise all seller account Meesho also should follow GST Registration.

Contents

DOWNLOAD FROM MAIL:

Every month Meesho will sent four excel report for GST to your mail id. You can download that and make a folder for that month and keep those four report in it.

For example if your sales is on August month the report for that month will receive before 9th of September. You can collect the reports from your mail and name the folder is of August and send to your auditor for registration.

DOWNLOAD FROM SELLER PANEL:

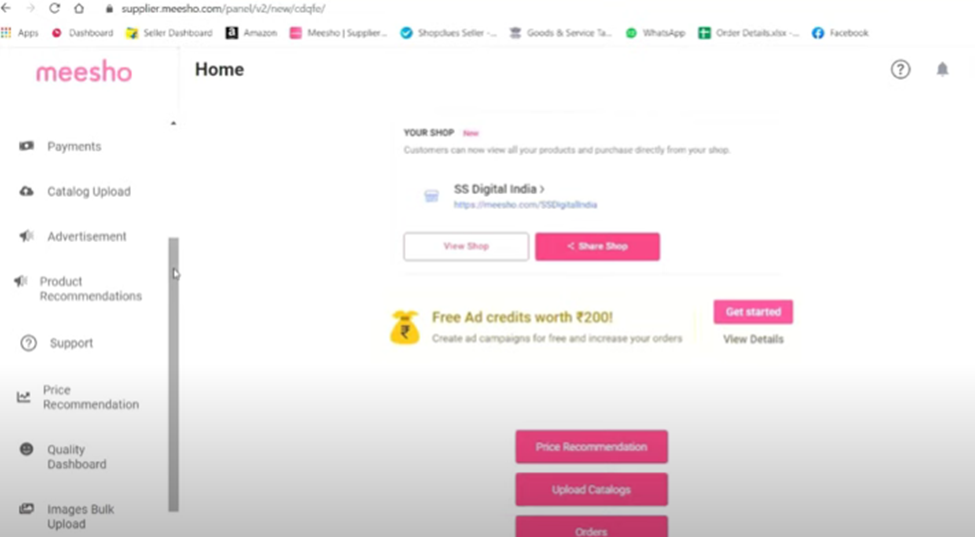

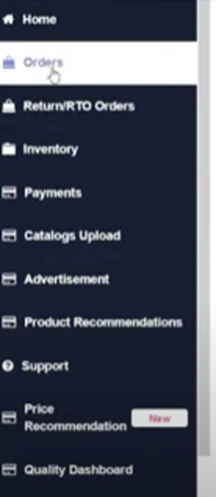

- Go to Meesho suppler panel.

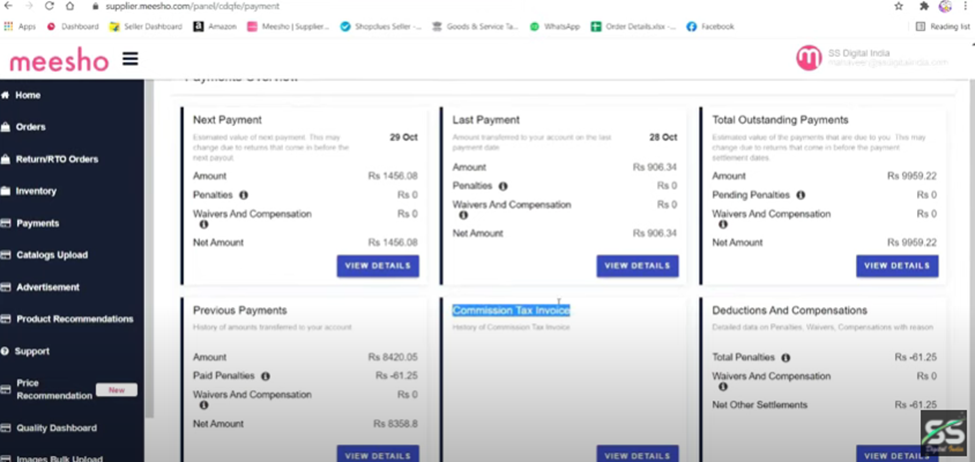

- Choose Payments section from the left panel.

- A new screen will pop up. Go to commission invoice section.

- Click on VIEW DETAILS button on that section.

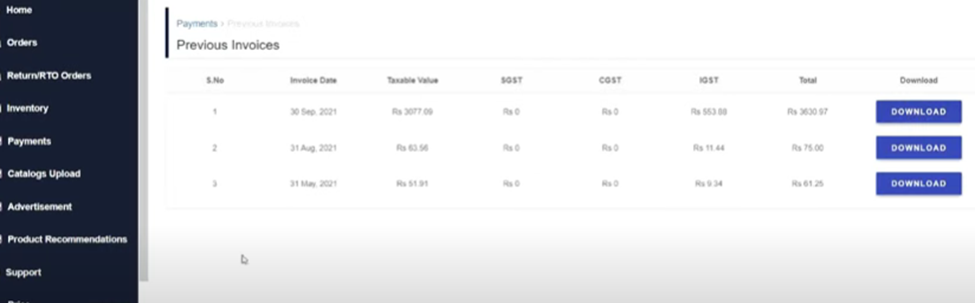

- Hit on Download button for which month you want to get invoices.(Note : This invoice will be in the form of pdf format)

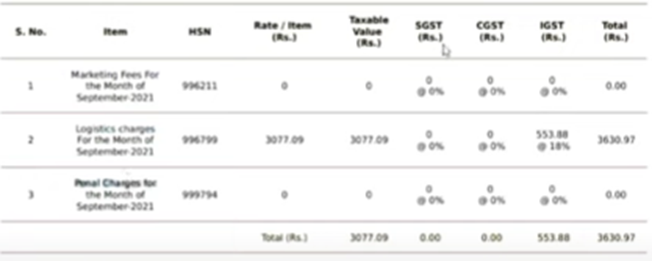

There will be three charges in the pdf as like below.

- Marketing fees for that particular month.

- Logistic charges for the month.

- Panel charges

Note : Create a Folder for that month and place this pdf in that folder.

Addition to this pdf download sales invoice by following the steps which i shown bellow.

- Go to meesho seller panel.

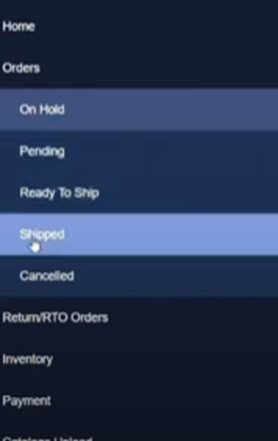

- Choose orders from the left panel.

- Choose Shipped option from the sub menu

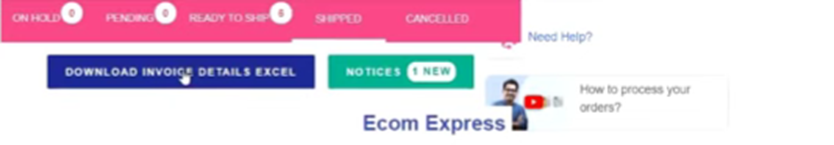

- There will be a new screen will get pop up on the right.

- Click on DOWNLOAD INVOICE DETAILS EXCEL.

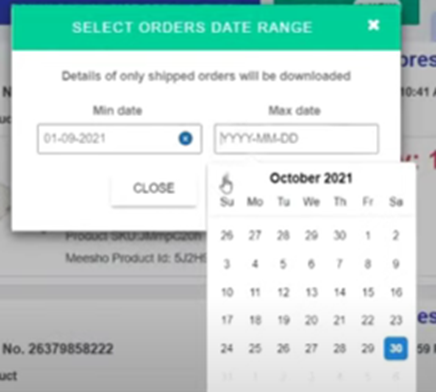

- It will ask for Select order date range.

- Click on Submit button.

- GST Invoice will get downloaded.

- Save this excel in the same folder which we created earlier.

Send the folder to your auditor or if you well known with registration process then get done with it.

Conclusion:

Hope you get an idea about the GST Report generation process. Keep going succeed your business.